|

Exhange Rates

|

|

Exchange Rates

Exchange Rate

Variances The system

considers 2 types of variance: 1.

Exchange Rate Variance 2. Exchange Rate Revaluation

If you are not familiar with the

effects of exchange rate variances, and the need to account for them, you should

discuss this aspect of the system with your accounting prior to

proceeding.

The variance is a result of the exchange rate

used for calculating invoice/credits being different from the exchange

rate used for the receipt.

Example:

Invoice $1500 @ 1.50 =

£1000

Receipt $1500 @ 1.40 = £1071.43 (a gain of £71.43)

There

is no ($) debt left after the receipt but there is a balance when converted to

base (£71.43), this balance needs to be written off.

Unprinted/proforma items

are not included in any calculation.

The

variance is a result of revaluing, in effect, the outstanding foreign currency

transactions at a new exchange rate.

What are the benefits of using

the system?

Users can enter

receipts using daily commercial exchange rates rather than system rates,

which may not be representative of the true situation.

Example:

Student owes

£1000 but wishes to pay in US$.

Using system rate: $1400 @ 0.7 =

£980

Using a commercial rate: $1400 @ 0.68 = £952

At a minimum, revaluations are necessary for year-end purposes, but users are recommended to consider completing a revaluation at each accounting period end.

Can this part of the system be

switched off?

Yes, but if you use the nominal

ledger posting reports in your base currency, for accounting purposes, you will

not be able to balance your "ledger debtors" in your nominal ledger if you

revalue you accounting records but not Class!

Exchange rate variances can only occur on foreign

currency accounts.

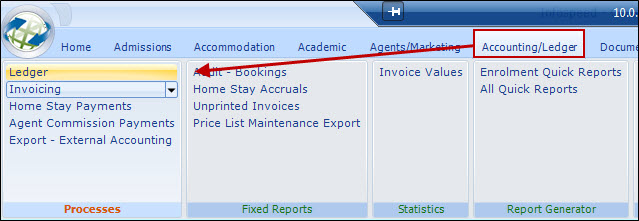

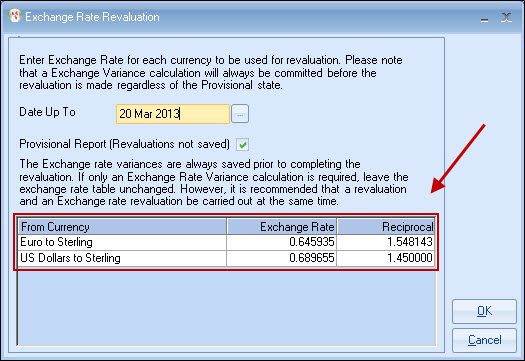

Computing Exchange Rate Variances

This can

be done by the system automatically and it is recommended that the "Exchange

Rate Variance" run and the "Revaluation" run are done together at the end of

each accounting period by simply selecting the Revaluation

option.

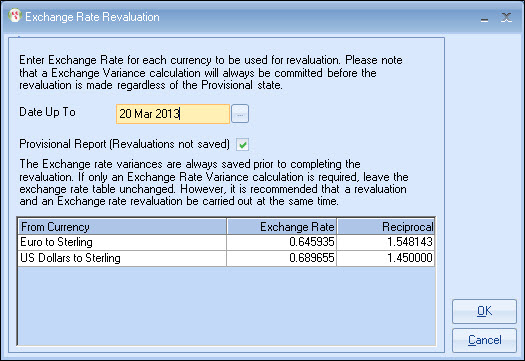

This will always calculate and record the Exchange Rate

Variances regardless of whether the Revaluation run is provisional or not.

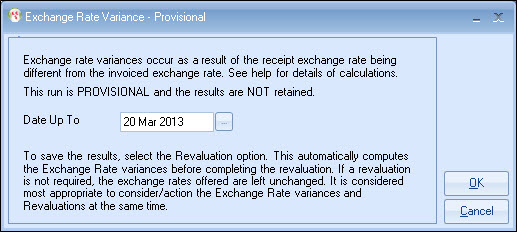

You can process the "Variance" run separately but it is

only Provisional

and does not write away the information.

There is no need to a "provisional" run once you are

familiar with the process.

It is important to note that the Variance part of

the Revaluation run will always be committed even if "provisional" is

ticked.

A transaction for both types of variance is created for

each account.

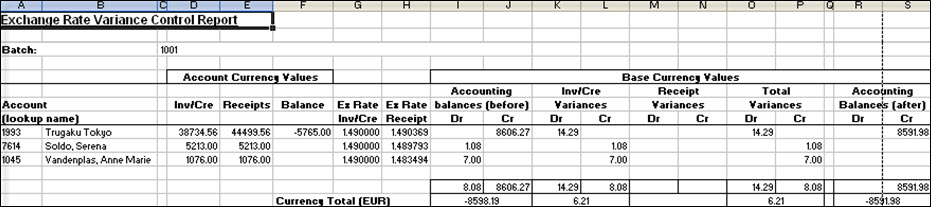

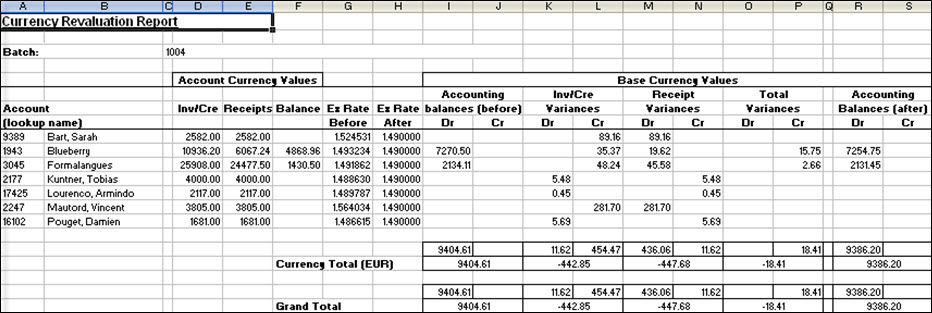

Excel reports are produced showing the variances.

The values

are included in the Nominal Analyses for the period.

Accounting

Issue :

It is suggested

that the 2 variances are recorded under a single heading within the accounts, as

splitting them has little value.

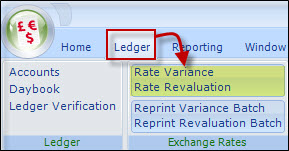

Exchange Rate Variance Report

Revaluation Report

Reprint

Select a report for reprint and enter the batch

number.

Batch numbers are shown against exchange rate

transactions.

Copyright 2013

Infospeed Limited